Is Bigger Better? Small Biotechs Use RWE and Analytics To Launch New Drugs

For companies bringing new drugs to market, a bigger footprint no longer means better results — and broader and more in-depth RWD assets are a key part of success for these first-time drug launchers.

The majority of new blockbuster drug launches will not come from the multinational pharmaceutical industry giants. They will come from small and mid-sized biotech and biopharmaceutical companies (SMBs), many of which will be launching their very first drugs. In fact, McKinsey projects that 56% of blockbuster launches due to take place between 2021 and 2025 will come from these first-time launchers. Moreover, these nimble young teams currently account for roughly a quarter of all new molecular entities submitted to the FDA since 2016.

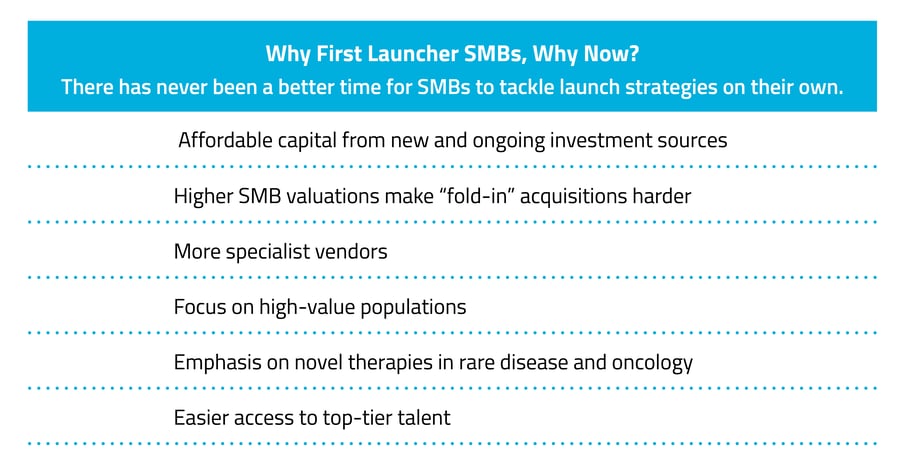

That’s a major shift from the status quo of big pharma licensing deals, partnerships, and acquisitions that had governed new drug development for the past several decades. Today, smaller players are finding it easier than ever to launch a new drug on their own, without a corporate safety net. They are armed with venture-backed investment, top talent looking to get in on the ground floor of a startup, as well as breakthrough data and analytics technology.

Data-Driven Approach to Clinical Development Levels the Field

One of the biggest drivers of the change is the fact that SMBs now have to access new data-driven technology platforms to shape their strategies. For example, one area where SMBs have historically struggled has been in pre-launch planning and analysis. Without the deep bench of HEOR staff to conduct market-sizing analytics or compile comprehensive comparative effectiveness research, many first-time launchers would develop their pre-launch strategies based on insights collected from a small number of key opinion and trial site leaders. Accordingly, many launches from inexperienced businesses have failed to reach adoption or launch value targets.

Today, however, with cloud-based, real-world data (RWE) analytics platforms more accessible than ever, it is possible for the smallest of the small biotech and biopharmaceutical startups to forecast various aspects of possible strategies and paths to commercialization with a level of sophistication that was previously only available to the largest companies. In addition, SMB clinical development and commercial teams can use these analytics to evaluate options for approaches to trial design and activation and explore key populations, influencers, and qualifiers to better understand the patient experience and tailor their strategies before the first trial site is even selected.

Bigger Isn’t Always Better

As this trend evolves, smaller teams will continue to have the advantage if they commit to solutions and partners that provide more flexibility. When a few people wear many hats within one organization, ensuring interoperability across core functions is key. Improved cross-functionality and compatibility are possible when the same tools, built on the same foundations of evidence, are used across multiple functional disciplines. This approach supports the generation of robust insights, and facilitates the sharing of those insights across multiple areas, without sacrificing huge capital investments.

Self-commercializing SMBs can find success by investing early to build a deeper understanding of their use-specific market and strategizing their product positioning in the context of the current landscape. They must also employ the most comprehensive datasets and technologies to inform their strategies through in-depth analytics and comparative forecasting. Komodo’s market-leading full-stack platform builds its software and tools atop the largest body of robust RWE available. Leveraging these tools ultimately improves success rates across all of the various disciplines SMB team members inform, allowing lean teams to effectively plan and execute in the most effective and cost-efficient way. For progressive SMBs launching their own products, there has never been a better time than the present.

About the Author: Bill Madigan is the CRO at Komodo Health, where he shapes business strategy to expand market impact. Madigan brings more than 25 years of experience commercializing software and services in the healthcare and Life Sciences industries. Prior to Komodo, he held leadership roles in Optum’s Life Sciences and provider businesses.

To learn more perspectives from Bill Madigan, Komodo’s Head of Market Development, check out his piece on Trends Transforming Healthcare.

To see more articles like this, follow Komodo Health on Twitter, LinkedIn, or YouTube, and visit Insights on our website.